Renters Insurance in and around Houston

Renters of Houston, State Farm can cover you

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Calling All Houston Renters!

Trying to sift through coverage options and providers on top of managing your side business, keeping up with friends and family events, takes time. But your belongings in your rented apartment may need the impressive coverage that State Farm provides. So when the unexpected happens, your sports equipment, linens and souvenirs have protection.

Renters of Houston, State Farm can cover you

Renting a home? Insure what you own.

Renters Insurance You Can Count On

Renters insurance may seem like last on your list of priorities, and you're wondering if you really need it. But imagine the cost of replacing all the valuables in your rented townhome. State Farm's Renters insurance can help when windstorms or tornadoes damage your stuff.

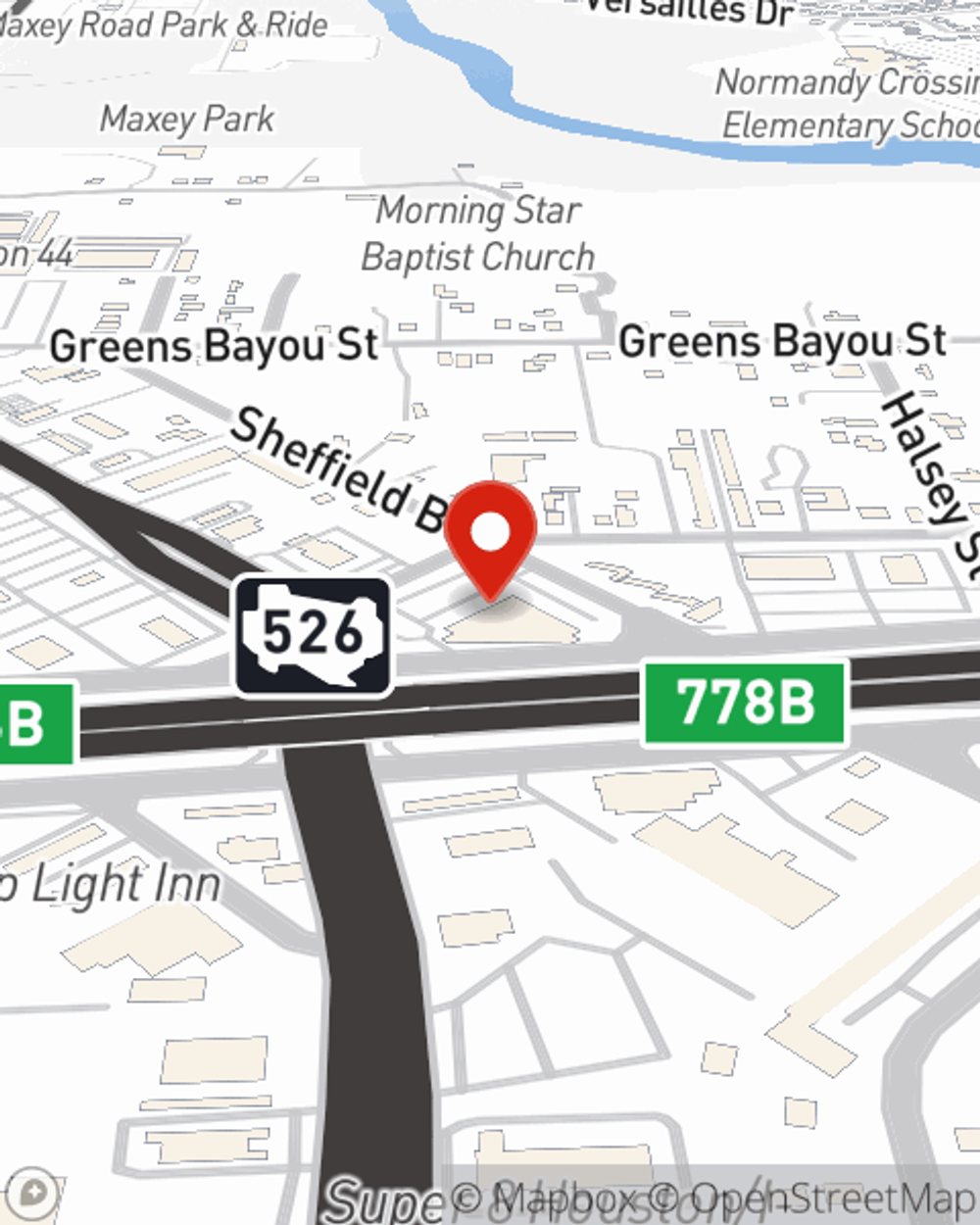

As a reliable provider of renters insurance in Houston, TX, State Farm helps you keep your belongings protected. Call State Farm agent Barry Hoskins today for a free quote on a renters policy.

Have More Questions About Renters Insurance?

Call Barry at (713) 453-7193 or visit our FAQ page.

Simple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Barry Hoskins

State Farm® Insurance AgentSimple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.